Loan Against Your Car

Get the funds you need without

selling your car.

Up to 200% of the cars valuation

Funds in 48 to 72 hours

Low Rate Of Interest

Rating | 70,000 Happy customers

By submitting this form, you agree to the Privacy Policy &

Terms of Use

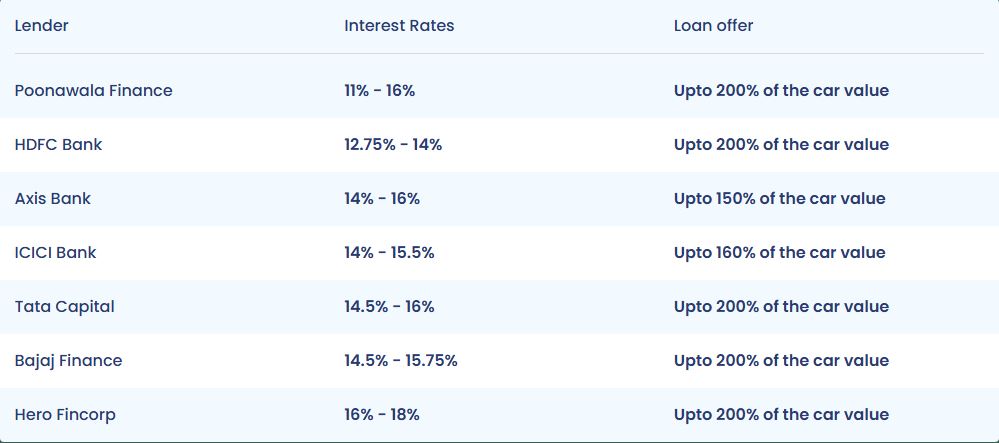

Interest Rates

Compare rates from multiple lenders, make an informed decision and

save money on your car loan with the right rate.

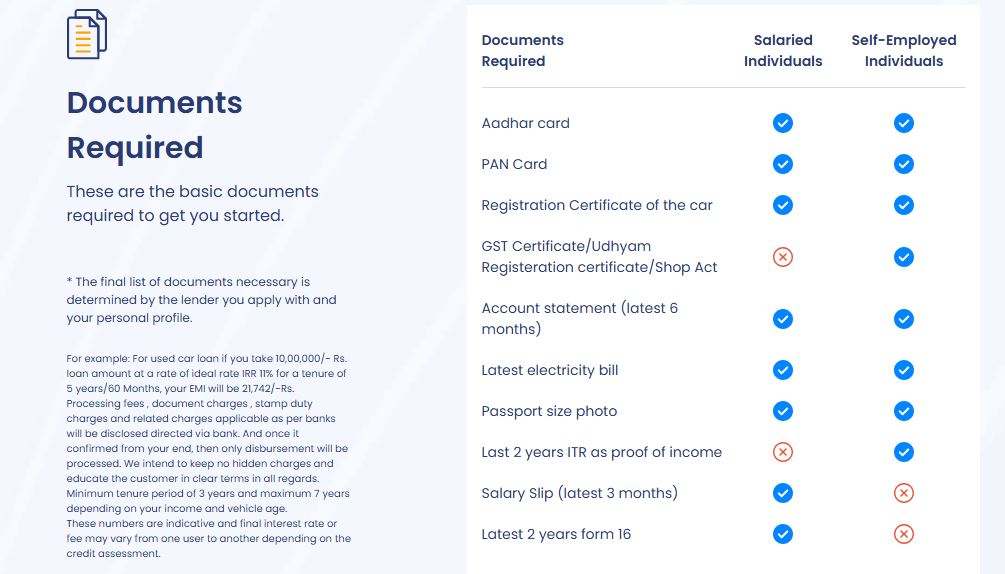

Loan Eligibility

Understand the requirements and Maximise your

chances of getting approved for a loan against your car.

Salaried Individuals

Age limit - The minimum requirement is 21 years, Should not be older than 65 years at the end of the loan term.

Job criteria - Individuals who have worked for at least 2 years, (Including at least one year with their present employer).

Minimum annual income - rupees 2,50,000 + their spouse's earnings.

Loan against car eligibility, in case you have an active

loan on your car.

Individuals must have paid at least 9 EMI's for that loan.

Self-Employed Individuals

Age limit - The minimum requirement is 21 years, Should not be older than 65 years at the end of the loan term.

Business criteria - Individuals who have been in business for at least 2 years.

Minimum annual income - rupees 2,50,000.

Get a top up loan, in case you have an active

loan on your car.

Individuals must have paid at least 9 EMI's for that loan.

FAQ's

Team Cash On Wheel offers loans against car which is a facility where you pledge your car in order to get a loan, where you can receive a loan up to 200% of the valuation of your car. You will receive funds in just 48-72 hours with the lowest possible interest rates (you will be provided with the comparison of interest rates from various banks).